Pricing

Or get it free when you purchase our 12-month MLRO CPD Programme 2025

Sample Tutorials

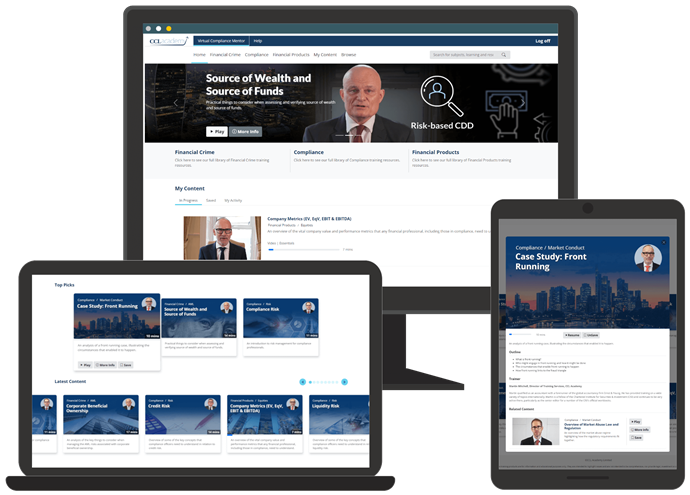

Preview a selection of 1-minute videos from our highly engaging and up to date on-demand platform below.

Compliance

Financial Crime

Financial Products

The Virtual Compliance Mentor Syllabus - What's inside?

See our collection of short video tutorials, webinar recordings and other resources designed to help Compliance and FCC professionals build essential knowledge and develop skills.

Compliance

- Compliance Monitoring 1: Introduction

- Compliance Monitoring 2: The Role of the First Line of Defence (1LoD)

- Compliance Monitoring 3: The Importance of Challenge

- Compliance Training

- Keeping Up To Date with Regulation

- Compliance Risk Assessments – coming soon

- Compliance Risk

- Operational Risk

- Credit Risk

- Liquidity Risk

- Market Risk – coming soon

- Overview and Scope

- Culture, Governance and Accountability

- Products and Services Outcome

- Price and Value Outcome

- Consumer Understanding Outcome

- Consumer Support Outcome

- Interaction between the Product Governance rules (PROD) and the Consumer Duty (Interactive Document)

- Conflicts of Interest

- Case Study: Conflicts of Interest

- What is a Financial Promotion?

- Reviewing Financial Promotions

- Product Governance

- Client Assets Rules

- Suitability and Appropriateness

- Fair Treatment of Vulnerable Customers

- Client Categorisation - coming soon

- Compliance Risks - Wealth Management - coming soon

- Overview of UK Market Abuse Law

- Case Study: Front Running

- Insider Dealing – coming soon

- Control of Inside Information – coming soon

- Market Manipulation – coming soon

- Market Abuse Controls – coming soon

- Senior Manager Conduct Rules

- Statements of Responsibilities

- The Certification Regime

- Individual Conduct Rules

- Non-Financial Misconduct

- Conduct Rules Training

- UK Whistleblowing Law and Regulation

- Overview of ESG

- ESG – Climate Risk – coming soon

- Corporate Governance – coming soon

Financial Crime

- ABC Risk Assessments

- Corporate Liability for Bribery - UK requirements

- Identifying Sanctions Risk

- Understanding Sanctions

- Managing Sanctions Risk – coming soon

- Sanctions Screening – coming soon

- AML/CTF Risk Assessments

- Proceeds of Crime Act (POCA): Failure to Report Offences

- How to Complete a Suspicious Activity Report (SAR) - UK requirements

- Identifying Politically Exposed Persons (PEPs) and Relatives & Close Associates (RCAs) - UK requirements

- Managing PEP and RCA Risks - UK requirements

- Source of Wealth and Source of Funds

- Corporate Beneficial Ownership - UK requirements

- Introduction to US AML Law and Regulation

- Trade-Based Money Laundering

- Money Laundering Risks – Capital Markets

- Money Laundering Risks – Wealth Management

- Money Laundering Risks – Payment Service Providers

- Domestic PEPs - UK Update 2024 (Interactive Document)

- Negative News Screening – coming soon

- Terrorist Financing – coming soon

- Fraud Risk Assessments – coming soon

- Facilitation of Tax Evasion – The UK Corporate Offence

Financial Products

- Company Metrics (Enterprise Value, Equity Value, EBIT and EBITDA)

- Special Purpose Acquisition Companies (SPACs)

- Private Equity

- Warrants

- Mergers and Acquisitions - coming soon

- Mechanics of an LBO - coming soon

- What is a Derivative?

- Options 1: Buying Call Options

- Options 2: Selling Call Options

- Options 3: Put Options

- Futures and Forwards

- Interest Rate Swaps - coming soon

- Shorting - coming soon

- Margin - coming soon

- Bond Yields

- Structured Products

- Exchange Traded Funds

- Hedge Funds

- Fund Management Key Concepts: Open Ended v Closed Ended (Interactive Document)

- Fund Management Key Concepts: Active v Passive Fund Management (Interactive Document)

- LIBOR Transition

- Interest Rate Swaps - coming soon

A full list of the video tutorials available on the platform, along with titles scheduled for release, is set out above. As part of the maintenance of the Virtual Compliance Mentor, content may be added, removed or updated from time to time.

Last updated: June 2025

Contact us

To discover more about the Virtual Compliance Mentor (VCM) or to get a quote, please get in touch by completing the form below. Alternatively, enjoy your complimentary VCM licence when you enrol in our MLRO CPD Programme here.

A comprehensive on-demand training resource for your Compliance team

Refresh or Upskill

Compliance professionals can refresh their compliance knowledge on specific areas of best practice and compliance fundamentals.

Written by Experts

All content is written and delivered by subject matter experts, former practitioners and professional trainers.

Growing Library

The growing resource library gives compliance staff access to more information over time at no additional cost.

Cost Effective

The VCM is included as part of our 360 package, or firms can purchase the library separately for their compliance staff.

Frequently Asked Questions

The Virtual Compliance Mentor is a growing library that consists of a range of video resources designed to help compliance and financial crime professionals develop the basic knowledge and skills that they require. Each tutorial lasts anywhere between 5-20 minutes, making it ideal for learning on the go.

You will be able to access all of the resources in the Virtual Compliance Mentor (VCM). As the VCM is a growing resource library, videos and other useful resources are added to the platform periodically. The platform currently consists of 70+ resources, including videos, webinar recordings and interactive documents.

Contact us if there is a specific topic that you would like to see.

Licences for the CCL Academy Virtual Compliance Mentor are sold as an entire library so videos cannot be purchased separately. However, there may be other solutions that meet your needs. Contact us to discuss your requirements.

If you would like to save costs on your compliance training, the CCL Academy compliance package, ideal for businesses, may be suitable for you. Read more about the CCL Academy 360 Approach to Compliance Learning.

The cost of the Virtual Compliance Mentor varies according to the number of licences you require. Contact us to receive a quote.

If your firm is enrolled in the CCL Academy 360 approach to compliance learning, you will automatically be able to access the Virtual Compliance Mentor upon launch as the VCM is complimentary as part of the 360 package. You can read more about the CCL Academy 360 approach to compliance learning here.

You can stream videos on any internet-enabled device that supports the playback of video content.

You can buy one, or as many licences as your firm needs.

The video content is not currently downloadable – an open internet connection is needed to stream the content.

Videos can be streamed on any internet-enabled device that supports the playback of video content.