MLRO CPD Programme 2026

Overview

The Money Laundering Reporting Officer (MLRO) CPD Programme is designed to support MLROs, Deputy MLROs, Compliance staff and other FCC professionals to keep up to date with the latest industry and regulatory developments and assist with their ongoing professional development in relation to Financial Crime prevention.

This 12-month MLRO CPD Programme is designed and delivered by experienced, former practitioners and is ideal for professionals working within the financial services industry. It covers the key regulatory topics including business and customer risk related to money laundering, terrorist financing, and proliferation financing, sanctions, fraud, and bribery & corruption.

The programme consists of 12 x 1-hour live tutorials (taking place approximately once per month), and 4 optional eLearning modules, totalling 15 CPD hours.

Participants have the flexibility of attending sessions live as they take place, or at a later date by watching the recordings on-demand though our dedicated CPD learning portal.

This MLRO CPD Programme is intended to provide CPD support to MLROs in any jurisdiction, by focusing on common themes, challenges and best practices. When you join the programme, you will also be given 12 months of access to our learning portal, the Virtual Compliance Mentor, (including archived tutorial recordings and a host of other learning resources).

Who is this for?

This course has been designed for MLRO’s and those working in financial crime prevention roles. The programme will also be of interest to legal, audit and risk staff within the financial services industry as well as Regulators. Staff who are new to financial crime prevention and compliance and want to keep up to date with the latest trends will also find this course useful.

Course Details

- The changing role of the MLRO

- The evolving FATF requirements towards risk

- The challenge of the firm-wide risk assessment

- Measurement and KPIs for effective financial crime compliance

- Factors and challenges in customer risk assessments

- Regulatory updates

- Suspicious activities and transactions best practice

- Ongoing monitoring of financial crime controls

- AI - friend, foe or a bit of both?

- Latest typologies and red flags in the MLRO context

- Using indices and other tools

- Crypto assets: risk, regulation and developments

eLearning

You will also have access to the following eLearning modules:

- AML Awareness for DFSA Regulated Firms

- Anti-Bribery & Corruption Awareness

- Fraud Prevention

- Sanctions

Upcoming Live Sessions

-

The challenge of the firm-wide risk assessment

10 Mar 2026 (14:00 - 15:00) -

Measurement and KPIs for effective financial crime compliance

15 Apr 2026 (13:00 - 14:00) -

Factors and challenges in customer risk assessments

13 May 2026 (13:00 - 14:00) -

Regulatory updates

10 Jun 2026 (13:00 - 14:00) -

Suspicious activities and transactions best practice

15 Jul 2026 (13:00 - 14:00) -

Ongoing monitoring of financial crime controls

12 Aug 2026 (13:00 - 14:00) -

AI - friend, foe or a bit of both?

09 Sep 2026 (13:00 - 14:00) -

Latest typologies and red flags in the MLRO context

14 Oct 2026 (13:00 - 14:00) -

Using indices and other tools

11 Nov 2026 (14:00 - 15:00) -

Crypto assets: risk, regulation and developments

09 Dec 2026 (14:00 - 15:00)

Recorded Sessions

-

The changing role of the MLRO

14 Jan 2026 (14:00 - 15:00) -

The evolving FATF requirements towards risk

11 Feb 2026 (14:00 - 15:00)

Delivery

The programme consists of 12 x 1-hour virtual training courses that are delivered live, and 4 x 45-minute eLearning modules, totalling 15 CPD hours.

Participants have the flexibility to join the virtual sessions live as they take place, or watch the recordings at a later date through our dedicated CPD learning portal.

Firms with more than 5 staff to train have the flexibility to deliver this CPD Programme training in-person by one of our trainers at your premises, or virtually via Zoom, Teams or Webex.

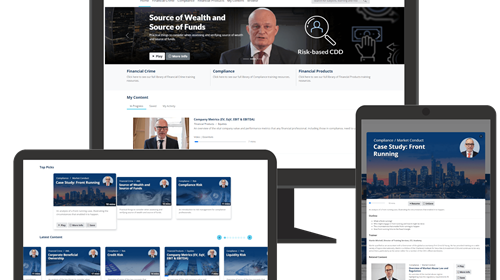

Virtual Compliance Mentor

Included in your MLRO CPD Programme

FCC and Compliance staff can refresh and upskill their compliance knowledge on specific areas of best practice with the Virtual Compliance Mentor, a growing on-demand learning platform designed to support compliance learning on the go.

The fully searchable and trackable platform consists of bite-sized video tutorials, webinar recordings and other learning resources relating to Compliance, Financial Crime, and Financial Products.